The

networked products and services segment consists of Sony's game business,

personal computer and other network-related businesses. Sony's games segment

operates through its subsidiary, Sony Computer Entertainment (SCEI), Sony

Computer Entertainment America (SCEA) and Sony Computer Entertainment Europe

(SCEE). These subsidiaries control the development, production, marketing, and

distribution of Sony's video games consoles, the PlayStation 2 (PS2),

PlayStation Portable (PSP), and PlayStation 3 (PS3). Furthermore, SCEI, SCEA

and SCEE enter into licenses with third-party software developers. The group

also manufactures a range of notebooks under the Vaio series.

Table 1: Sony Corporation: Key financials ($)

The above given financial figures shows that Sony is struggling from last one decade and net income is negative from 2009. One year before in 2008 it was worldwide financial crises but Sony has other story for this loss as it was losing its core business in TV division as well.

Table 2: Sony Corporation: Key financial ratios

The financial ratios also highlight Sony's weak financial muscles. The profit margin is decreasing from 2006 and till 2010 they are in negative. Profit per employee is decreased almost 60% which has great effect on the employee's working output. Overall Sony is losing from every hole.

Graph 1: Sony Corporation: Revenues & Profitability

The revenue and profitability graph has the same story in it that Sony's profit margin tremendously dropped in 2008 and after that Sony is still unable to strengthened itself. Net income is almost zero.

Sony Walkman:

Many observers consider Sony to be one of the most consistent and impressive innovators of consumer and industrial products (Cope, 1990; Fairhead, 1988). Within Sony, there has been no greater success than the Walkman. Sony has dominated the personal portable stereo market, worth $1 billion worldwide, for over a decade and has remained the leader, both technically and commercially, despite fierce competition from world-class competitors. Sony has competed against outstanding firms such as Matsushita, Toshiba, Sanyo, Sharp and Philips – consumer electronics giants with marketing savvy, financial strength, excellent engineering skills, a strong technology base, and world-class manufacturing.

The Walkman is an example of outstanding product family management. Sony's strategy employed a judicious mix of design projects, ranging from large team efforts that produced major new model 'platforms' to minor tweaking of existing designs. Throughout, Sony followed a disciplined and creative approach to focus its sub-families on clear design goals and target models to distinct market segments. Sony supported its design efforts with continuous innovation in features and capabilities, as well as key investments in flexible manufacturing. Taken together, these activities allowed Sony to maintain both technological and market leadership.

In 1978, Sony shifted responsibility for the design of tape recorders from their audio group to a group that has since made cassette decks and boom boxes (Sony, 1989a). At the time, the engineers in the audio group were forced to scramble to generate new tape-based products. As it happened, several engineers were working on a stereo cassette recorder based on the compact, high performance Pressman recorder that had been launched in 1977. The Pressman was a handy device designed to be used by reporters to record interviews. In trying to master the technique for installing recording the playback mechanisms in small spaces, Sony engineers decided first to develop a prototype equipped only with a playback mechanism. This prototype reproduced sound of such high quality that the engineers felt there might be a potential market for the player alone. Music lovers were already buying prerecorded music cassettes, but the tape recorders available at the time were large and only marginally portable.

Meanwhile, another research team was working in the same building on a set of lightweight headphones. This was part of an ongoing research effort to miniaturize components of all kinds. The program was driven by Sony's twin design goals of greater audio fidelity and greater portability for all of its products. At the time, the lightest headphones in the world weighed about 100 g (3.5 oz.). The team had decided to produce headphones weighing about half that and they had already developed a prototype model. The miniature headphone and cassette player teams were unaware of the others' work until the spring of 1979 when Masaru Ibuka (Sony's Honorary Chairman) dropped by and made the connection between the two projects.

Production of a prototype Walkman began in Japan in 1978. Sony introduced the Walkman to the Japanese market in July 1979. 30,000 units of this model were produced and the entire stock was sold within 3 months. The Walkman was a stunning hit and production could not keep up with demand. The first full production model, the TPS-L2, sold 1.5 million units in just 2 years. Sony has led the worldwide market for personal stereos with its worldwide market share on a unit basis hovering around 40% for over a decade. On a revenue basis Sony's market share has remained around 50% as shown in table; Sony has comparable market shares in both the US and Japanese markets. Sony has dominated the worldwide market despite the competence of its competitors. General Electric held about 10% of the market in the US, but was primarily a distributor of lower priced models made overseas.

Table 3: Personal stereo revenue market share (1989-1990)

Battle for market share and profit sanctuary:

More than 550 models of personal stereos appeared on the US market during the 1980s. Many low-priced models that were manufactured in Southea st Asia and sold under private labels.

Graph 2: Worldwide headphone stereo market

In personal portable stereos, as well as in many other product categories, the number of customers buying consumer products in the US and European markets is larger than in the Japanese market. For example, 42% of Sony's Walkman units were sold in North America, 40% in Europe, 11% in Japan and 7% in the rest of the world in 1988. To be successful in markets outside their home base, firms must have models that appeal to customers around the world. Porter has suggested that if firms must have their headquarters in markets that anticipate the demands of markets elsewhere, they are likely to be more successful (Porter, 1991). We looked at this issue by comparing personal stereo models sold in the United States and Japan.

Japan vs United States:

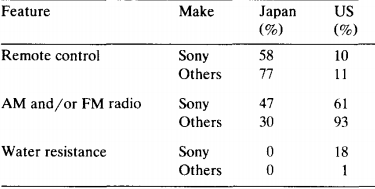

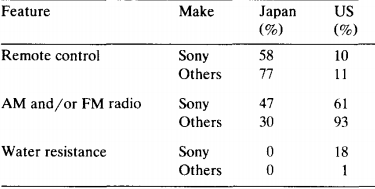

The below given table compares the price and size of the personal portable stereo models sold by the five major Japanese manufacturers in US and Japanese markets during 1989-1990. The majority of personal stereo models in the US sold for $55-$60, while Japanese models typically cost between $130 and $150.

Table 4: Percentage of models with given features in US and Japan

These

price differences are generally related to the physical sizes of the models

sold in each market. The Japanese models were generally smaller and had higher

sound quality than the average model sold in US.

There

were differences in the model mix between Japan and the US in the product

features. Japanese consumers tend to have more urbanized lifestyles. They live

in cramped accommodation and commute long distances to work, often by subway or

train. Not surprisingly, Japanese consumers prefer small, high performance,

rechargeable models. Japanese models tend not to have a radio tuner, as there

were far fewer radio stations in Japan than in the US. Finally, many Japanese

models had remote controls that allow the tape to be controlled from a wand

built into the headphone cord. This feature meant little to most American

joggers, but had great value to Japanese commuters packed into subway cars so tightly

that they cannot move their hands.

Sony’s

major markets were Japan, United States and Europe, which are totally different

from adaption and cultural point of view. Therefore Sony as other competitors

launched customized models for each market to grab the market share by

providing customized products.

Table 5: Number of models in product line (1989-1990)

Sony

was leading on all platforms as compared to his competitors and was focusing on

each market segments. Sony launched second generation walk man by reducing a

considerable amount of weight. The body of the WM2 weighed 9.9 oz. and the

headphones weighed only 1 oz. At the time, it was the lightest product of its

kind in the world.

Sony

hired the professional designers’ team who changed the design with every new

model but their focus was on aesthetics and to reduce the overall weight of the

product but they didn’t paid attention on the core functionality of walk man.

In next section of this assignment we will try to find the reasons of failure

of such a success story of 80s; Sony Walkman.

What went wrong?

When

the Sony Walkman went on sale 35 years ago, it was shown off by a skateboarder

to illustrate how the portable cassette-tape player delivered music on the go -

a totally innovative idea back in 1979. Sony has sold 385 million Walkman

machines worldwide in 35 years as it evolved from playing cassettes to compact

disks then minidisks; a smaller version of the CD and finally digital files. Today,

Sony Corp. is struggling to reinvent itself and trying to win back its

reputation as a pioneer of gadgetry once exemplified in the Walkman.

What

went wrong is a tale of lost opportunities and disastrous infighting. It is

also the story of a proud company that was unwilling or unable to adapt to

realities of the global marketplace.

Walkman

was clunky: The plastic tape player required frequent replacing of two

AA batteries. There was no shuffle. There was no storage to speak of. It could

play only the number of songs on the tape. Jumping to a new song tasked an

owner with fast forwarding, an inexact process that meant repeated stops to

find the start of the desired tune.

Digitization:

Sony’s gravest mistake was that it failed to ride some of the biggest waves of

technological innovation in recent decades: digitalization, a shift towards

software and the importance of the Internet. One by one, every sphere where the company

competed from hardware to software to communications to content was turned by

disruptive new technology and unforeseen rivals. And these changes only

highlighted the conflicts and divisions within Sony. In case of walk man, Sony

was leading the stereo market almost all over the world, especially in Japan

and United States but Sony failed to take functionality of Walkman from

traditional cassette to digitize the music. With its catalogue of music and

foundation in electronics, Sony had the tools to create a version of the iPod

long before Apple introduced it in 2001.

Lack

of Agility: The Sony co-founder, Akio Morita, envisioned as early as

the 1980s marrying digital technology with media content for a completely new

user experience. It didn’t happen because Sony engineers resisted the power of

the company’s media divisions. Then Sony wrestled with how to build devices

that let consumers download and copy music without undermining music sales or

agreements with its artists. The company went its own way: its early digital

music players, for instance, used proprietary files and were incompatible with

the fast-growing mp3 format.

By

the time the different divisions had been corralled into cooperating, Sony had

lost its foothold in two crucial product categories: televisions and portable

music devices. It was late to flat-panel displays, as well as to digital music

players like the iPod. After disappointing sales, Sony pulled the plug on its

answer to Apple’s iTunes, the Sony Connect online store, after just three years

Obsession

with hardware: Sony’s obsession with hardware led its Walkman division to

focus on just reducing the weight; otherwise if they think to merge the

software with hard then they could achieve their weight losing strategy with

much better products like iPod. Also a delay in developing the console’s

Blu-ray DVD player forced Sony to push back its release. Sales suffered because

the PlayStation 3 cost much more than rival models from Nintendo Co. Ltd and

Microsoft Corp. Sony was also slow to move into the world of online games,

giving Microsoft a head start.

Typical

Japanese style of Management: Sony’s leaders have had trouble wielding

authority over the sprawling company. Sony remains dominated by proud,

territorial engineers who often shun cooperation. For many of them,

cost-cutting is the enemy of creativity; a legacy of Sony’s co-founders, Morita

and Masaru Ibuka. But the founders had more success than recent executives in

exerting control over division managers. Executives complain privately of

recalcitrant managers who refuse to share information or work with other

divisions.

Lower

cost competitors: Lower-cost manufacturers from South Korea, China and

elsewhere, meanwhile, are increasingly undercutting Sony and other high-end

electronics makers. As Sony’s brand started losing much of its luster, the

company found that it had a harder time charging a premium for its products.

Long

and confusing Menu: Sony made a confusing catalogue of gadgets that

overlap or even cannibalize one another. It has also continued to let its

product lines mushroom: 10 different consumer-level camcorders and almost 30

different TV sets, for instance, crowd and confuse consumers. “Sony makes too

many models, and for none of them can they say, ‘This contains our best, most

cutting-edge technology,’” Sakito said. “Apple, on the other hand, makes one

amazing phone in just two colors and says, ‘This is the best.’”

References:

- Sony Corporation: Assets &

Liabilities. Graph. Home Entertainment

Software Industry Profile: Global (2011, summer), p35. Retrieved March 15,

2015 from Business source complete

- Sony Corporation: Revenues &

Profitability. Graph. Home Entertainment

Software Industry Profile: Global (2011, summer), p25. Retrieved March 15,

2015 from Business source complete

- Sony Corporation: Key financials.

Chart. Home Entertainment Software

Industry Profile: Global (2011, summer), p33. Retrieved March 15, 2015 from

Business source complete

- Electronic Arts Inc.: Key facts.

Chart. Home Entertainment Software

Industry Profile: Global (2011, summer), p22. Retrieved March 15, 2015 from

Business source complete

- Sony Corporation: Key financial

ratios. Graph. Home Entertainment

Software Industry Profile: Global ( 2011, summer), p34. Retrieved March 15,

2015 from Business source complete

- Cope, N. (1990) Walkmen's global stride, Business (UK), March, 52-59

- Fairhead, J., 1988, Design for

corporate culture, National Economic

Development Office, London March.

- Porter, M., 1991, The competitive Advantage of Nations

(Free Press, New York)

- http://abcnews.go.com/Technology/story?id=7979893 visited on March 10, 2015

- http://www.cnet.com/news/goodbye-walkman-thanks-for-the-ipod/

visited on March 10, 2015

- http://www.livemint.com/Companies/WSFk5Ck18LpCGHKaBcFogM/How-Sony-failed-to-keep-up-with-the-tech-revolution.html

visited on March 10, 2015

.PNG)

.PNG)